Green hydrogen can be the fuel of the future, but how do we make that a reality?

Tomorrow delegates will gather in Dubai for COP28, which will see the first global stocktake on progress towards 1.5 degree celcius targets. We should anticipate a grim assessment, with some analysis indicating that we could be close to 3 degrees celcius of warming this century rather than the 1.5 degrees targeted in the Paris Agreement. According to the UN, it will mean “looking at everything related to where the world stands on climate action and support, identifying the gaps, and working together to agree on solutions pathways”[i]. In light of everything that we have been doing at NEOM Green Hydrogen Company, I find myself considering where green hydrogen is positioned on that pathway and what can and should be done to encourage more rapid adoption of and investment in green hydrogen.

Demand for green hydrogen is certainly rising and by 2050 it is forecasted to reach over 530 million tons.[ii] But while the market is growing and demand emerging, it’s not yet fully developed and all of us have a role to play for this to happen. Suppliers want to be bold in developing the infrastructure and volumes needed to meet these forecasts, but enabling this to happen at speed will hinge on confidence in the green hydrogen business case. We’ve already started on that journey and the cost of producing green hydrogen is falling, thanks to the continuing drop in renewable energy technology costs, including wind, solar [iii][iv][v][vi], and large-scale investments such as the one being made by NEOM Green Hydrogen Company. The price of onshore wind dropped by 70%, and solar fell by 89%[vii] because, unlike fossil fuels, the costs for those energy sources are directly linked to advancements in technology. Likewise, the cost of electrolysers has been predicted to continue to fall over the next decade.[viii]

The impact of individual projects can certainly move the needle on this issue, and at NEOM Green Hydrogen Company we are building the world’s largest green hydrogen plant, making us the first company globally to scale up green hydrogen production. When full production starts in 2026, our facility will likely be the most cost-competitive in the world. We will export up to 600 tonnes per day of carbon-free hydrogen globally in the form of green ammonia under a 30-year off-take agreement with Air Products. We aspire to lead the charge on green hydrogen, enabling the development of a future marketplace and ensuring its full potential is realised for the benefit of our communities, industries, and the world.

Helping connect producers with consumers and ensuring that reliable supply routes are in place will give governments and suppliers the confidence to commit. NGHC is reliant on strong technology partners and suppliers for its equipment, with early agreements with the likes of thyssenkrupp nucera, Baker Hughes, Topsoe, and Air Products as our key technology partners, as well as Envision Energy critical to our success. It will be essential for the whole hydrogen supply chain to continue to develop and expand rapidly over the coming years.

What we inevitably circle back to is the question of confidence to invest, which is where the role of governments will be pivotal. Many have made a start – at the end of last year, 32 governments had a hydrogen strategy in place.[ix] What we need now is action to bring forward the frameworks that will accelerate the scaling up of clean hydrogen production and, in turn, drive commercial viability. This means global agreement on regulation and definitions of green hydrogen, and funding mechanisms to incentivise the production and use of clean hydrogen. There are many different ways to achieve this goal – the Inflation Reduction Act in the USA is one example. Regardless of the specific mechanisms, actions by governments globally must be bigger and bolder in order to move this nascent industry forward at the pace required to be able to make a material impact in the reduction of carbon emissions.

Green hydrogen will play a central role for countries striving to meet their climate change commitments. Governments and the investments and projects they support will inform and inspire similar actions across the world tomorrow, thereby creating a commercially viable global market stimulating advancements in clean hydrogen and ensuring the fuel helps every economy achieve net zero emissions.

Without significant investments in technology and the required infrastructure, which could take years to put in place, we risk falling behind on our journey along that path to net zero thereby jeopardising our ability to deliver clean hydrogen as the ‘fuel of the future’. We must act together, today, to make it the fuel of right now.

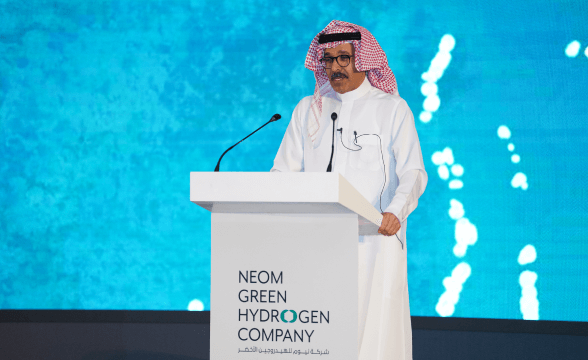

David Edmondson

Chief Executive Officer at NEOM Green Hydrogen Company

#NGHC #WorldYouthSkillsDay #NEOMGreenHydrogenCompany #EnergyTransition #FuelingFutures #GreenHydrogen

[i] https://unfccc.int/topics/global-stocktake

[iv] https://ryzehydrogen.com/2022/01/19/green-hydrogen-prices-will-plummet/

[vi] https://rethinkresearch.biz/articles/market-dynamics-to-drag-green-hydrogen-to-1-50-kg-by-2030/

[vii] https://ourworldindata.org/cheap-renewables-growth

[ix] https://www.iea.org/energy-system/low-emission-fuels/hydrogen